Did you like what you read? Sharing is caring!

March 24, 2023

by: Simple Lifestyle PH

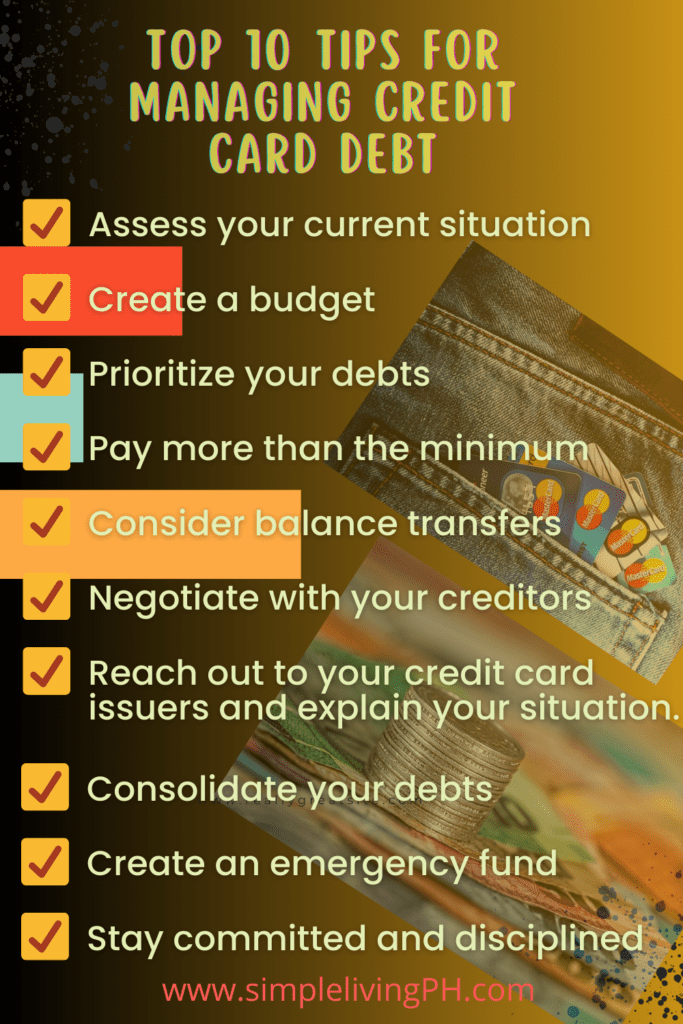

We understand that managing credit card debt can be overwhelming and stressful. However, with the right tools and strategies, you can regain control of your finances and work towards a debt-free future. In this post, we’ll provide you with 10 effective tips for managing credit card debt, complete with detailed introductions and examples for each tip. Remember, you’re not alone in this journey, and by taking small, consistent steps, you’ll soon see positive results.

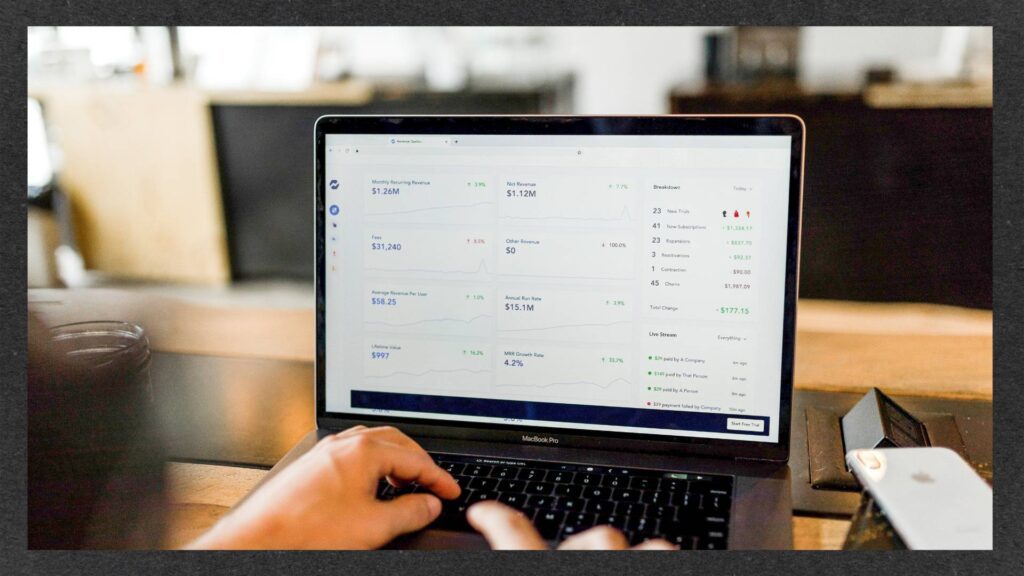

1. Assess your current situation: Understand your starting point

Knowing where you stand is crucial when it comes to managing credit card debt. To begin, you’ll need to gather all your credit card statements and create an overview of your balances, interest rates, and minimum payments. This initial assessment will provide you with valuable information for developing a tailored plan to tackle your debt.

Example: Gather your credit card statements and create a list detailing the balance, interest rate, and minimum payment for each card. This will help you understand your overall debt situation and prioritize your repayment strategy.

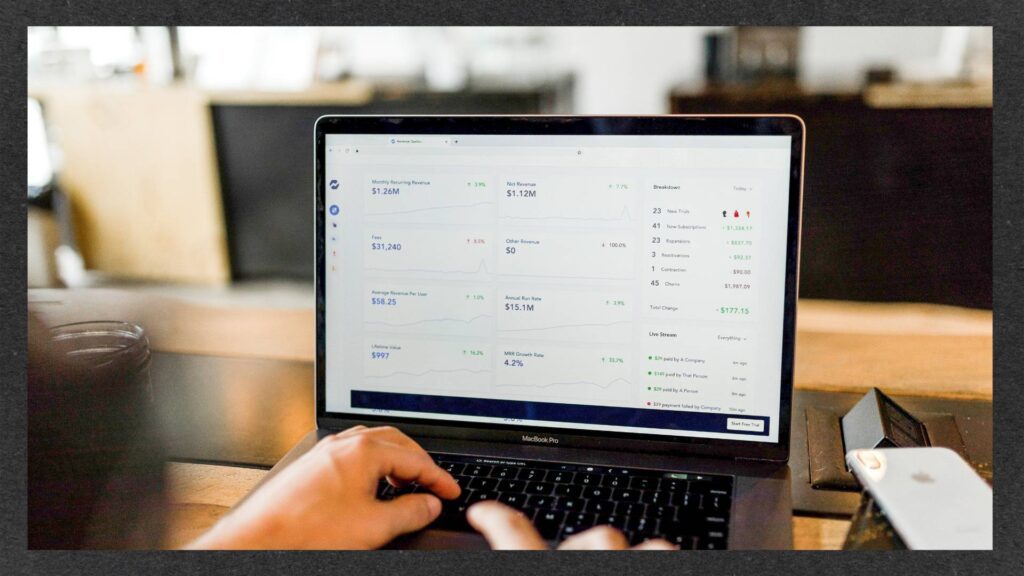

2. Create a budget: Plan your financial journey

A well-planned budget serves as a roadmap for managing your finances. By tracking your income sources and expenses, you can identify areas where you can cut back or save money, enabling you to allocate more funds towards debt repayment.

Example: Draft a detailed budget, including all your income sources (salary, freelance work, etc.) and expenses (rent, groceries, utilities, etc.). This will help you see where you can save money and allocate more towards paying off your credit card debt.

3. Prioritize your debts: Focus on the most expensive first

Organizing your debts according to their interest rates will help you save money in the long run. By focusing on paying off the most expensive debt first, you can become debt-free faster.

Example: Rank your credit card debts based on their interest rates, with the highest at the top. Pay off the highest-interest debt first while making minimum payments on the others.

4. Pay more than the minimum: Accelerate your debt repayment

Going beyond the minimum payment required not only helps you reduce your overall debt faster, but it also minimizes the amount of interest you’ll pay over time.

Example: If the minimum payment on your $5,000 balance is $200, try to pay $300 or more. This will help you pay off your debt faster and save on interest charges.

5. Consider balance transfers: Take advantage of lower interest rates

Balance transfers can be a useful tool for saving money on interest charges if you qualify for a lower interest rate credit card. However, it’s crucial to read the fine print and understand any fees associated with balance transfers.

Example: Research credit cards with lower interest rates for balance transfers, and transfer your high-interest balances to save on interest charges. Make sure to pay attention to any fees and the duration of the promotional rate.

6. Negotiate with your creditors: Seek more favorable terms

Credit card companies may be willing to work with you if you’re struggling to make payments. Reach out to your creditors to see if they can lower your interest rate, waive fees, or offer a modified payment plan.

Example: Call your credit card company and explain your financial situation. Ask if they can lower your interest rate or waive late fees to make your payments more manageable.

7. Consolidate your debts: Simplify your debt management

Debt consolidation involves combining multiple credit card balances into a single loan or credit card with a lower interest rate. This can make managing your debt easier and save you money on interest charges.

Example: Apply for a personal loan at a lower interest rate than your credit cards, use the loan to pay off your credit card balances, and then make one monthly payment towards the loan. This simplifies your debt management and could save you money on interest charges. However, be cautious and carefully evaluate the terms and conditions before consolidating your debts.

8. Create an emergency fund: Prepare for the unexpected

Start building an emergency fund to cover unexpected expenses, such as medical bills or car repairs. This will help prevent you from relying on credit cards for emergencies and further increasing your debt.

Example: Aim to save at least three to six months’ worth of living expenses. If your monthly expenses are $3,000, try to save $9,000 to $18,000 as your emergency fund. Start by setting aside a small amount from each paycheck and gradually increase your savings.

9. Seek professional help: Get expert guidance

If you’re struggling to manage your debt on your own, consider seeking help from a non-profit credit counseling agency. These organizations can provide guidance on budgeting, debt management, and may even help negotiate with your creditors on your behalf.

Example: Contact a non-profit credit counseling agency, such as the National Foundation for Credit Counseling (NFCC), for free or low-cost counseling services. They can help you develop a personalized debt management plan and offer support throughout the process.

10. Stay committed and disciplined:

Persevere on your path to financial freedom

Stick to your budget, avoid unnecessary expenses, and resist the temptation to use your credit cards for non-essential purchases. With dedication and perseverance, you’ll gradually reduce your credit card debt and achieve financial freedom.

Example: If you’re tempted to buy a new pair of shoes that you don’t need, remind yourself of your debt repayment goals and choose to put that money towards paying off your credit card instead. Stay focused and celebrate each milestone on your path to becoming debt-free.